Mastering Market Indicators and Trends: Harnessing Sentiment for Success

Updated July 13, 2024

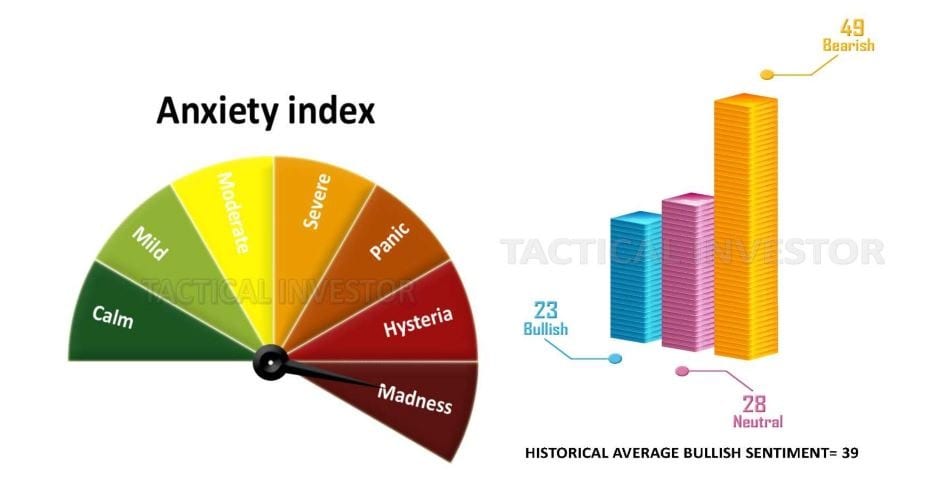

How can anyone explain the Sentiment data below using old-school logic? You can’t. As we stated in the last update, a negative sentiment will only surge in the Twilight Zone while the markets are trending higher. Market Update July 31, 2020

We live in an era of remarkable and unpredictable markets, with bullish sentiment defying logic and reason. It’s a strange time where the Nasdaq is trading at new highs, the Dow is recovering its losses and is soon to set new records. Yet, the bullish sentiment is at levels typically associated with a severe market correction.

The old way of doing things seems dead, and there’s an overwhelming feeling that we’re entering a new paradigm in the investing world. It’s a surreal experience for investors, like witnessing a magic trick that defies all reasoning. Understanding it all has become challenging, and even the most experienced traders struggle to stay afloat.

Tracking market sentiment is essential in times like these, as it offers invaluable insights for investors. Sentiment can help us better understand what’s happening in the markets and how to prepare for what’s yet to come.

That’s why we’re warning all our subscribers early on in the cycle; the cycle of insanity has just begun, and we must be prepared for what’s to come. It’s a disordered market where everyone risks losing their minds, except for the 10% of players willing to adapt to the new reality.

We’re living in extraordinary times,

Hence, we must pay close attention to the markets to survive and thrive. The bullish sentiment may be low, but that doesn’t mean we should panic. Instead, we must keep a level head, stay informed, and be prepared for the unimaginable to come to pass. The future of investing appears uncertain (at least to the untrained eye), but one thing is clear: studying market sentiment holds the key to our success.

Be A Contrarian. Outwit the Crowd

Remember this statement. Oppose the Fed and wind up dead; in this instance, dead refers to dead broke. Sol Palha

The Fed’s influence on the economy is unparalleled, as it can redefine reality through controlling the purse strings. It’s easy to fall prey to the noise generated by experts who claim the Fed is overplaying its hand and running out of power. But such statements are worth little more than a barrel of salt and a jar of whiskey and could only be conjured up by a member of Ward 12.

It’s important to remember that opposing the Fed could lead to financial ruin, as the Fed’s control is absolute. In other words, if you go against the Fed, you will likely end up dead broke. Our analysis of mass psychology also indicates that the masses are not yet ready to abandon fiat, so until that changes, fiat will remain the norm, even if it inflicts misery on society. This is where market indicators come into play, as they can help us navigate the complexities of the market and make informed decisions.

Misery loves company and stupidity simply demands it. Sol Palha

Market Indicators and Trends: Think Out of the Box

Deploy 1/3rd of your funds whenever the Dow sheds 1500 or more points cumulatively within a 9-day trading period (there are only five trading days in a week). For example, if the Dow were to shed 1500 points in 3 days, you would use the above strategy.

- Deploy another 1/3rd when the Dow shed 1800 to 2400 points

- Purchase another 1/3rd if the Dow sheds 2600 to 3000 points

- Deploy one full position (three lots) in one shot if the Dow sheds more than 3600 points.

This strategy remains in effect until the trend changes. From time to time, you can write in and request updates. Note this is not an official strategy. It’s a suggestion for the trader who wants to improve their skills and is willing to work independently utilising the above directions.

You can buy index-based funds such as XRT, QQQ, and TQQQ; one can also purchase AI stocks such as GOOGL, NVDA, FB, AAPL, etc.; One can also buy options on some or all of the above the suggested ETFs and or stocks. Market Update July 31, 2020

Market Indicators and Trends: How To Effectively use Sentiment data

The excitement of potential profits can sometimes lead to tunnel vision and cause investors to overlook important information. As the saying goes, “The devil is in the details”. In this case, most subscribers forgot the details in the opening statement.

This highlights the importance of paying attention to market indicators and sentiment rather than solely focusing on specific stock or ETF plays. A successful investor must be able to step back and look at the big picture, considering various market indicators and sentiment data to make informed decisions.

We will keep adapting to these changes, but if you are ready to take your game to the next level, consider implementing this strategy. Buy regular Index funds, Leveraged Indexed funds or options when the Dow pulls back in the following ranges. Understand that the risk increases as you move from Index funds to Options. This strategy is for the trader that is willing to do some footwork by utilising our sentiment data, the trend data and any general guidance we provide to enhance their returns further. Market Update July 31, 2020

The above strategy requires a certain level of dedication and willingness to work hard. It’s not for the average trader looking for a quick fix or an easy way out. It’s for those willing to take their game to the next level and do the necessary footwork.

Market Indicators and Trends: Adaptability is crucial to success

The suggested stocks and ETFs list is not set in stone but is a starting point for advanced traders to modify or adjust as they see fit. If you’re unsure about a particular strategy, it’s best not to attempt it until you’re ready. Start slow and steady and gradually work your way up to swift and keen. Successful trading requires patience, discipline, and a willingness to learn from mistakes. By using market indicators to your advantage and constantly adjusting your strategy, you’ll be well on your way to achieving your financial goals.

That statement clearly states that this strategy is for the trader willing to do some footwork and take their game to the next level. This implies that one can modify or adjust the suggestions. The suggested list of stocks and ETFs was not final but an illustration of what an advanced trader could do. The proposed list included QQQ, TQQQ, FDN, AAPL, NFLX, NVDA, and any instrument you choose.

The Art of Being a Financial Maverick: How to Thrive as a Contrarian Investor

Every other index is playing catch up to the Nasdaq; in a way, it’s like the dogs of the dow theory, which inadvertently states that every dog will have its day in the sun. Another reason the Dow is lagging and the Nasdaq is soaring is that the dumb money, which is the vast majority of players, is still sitting on the sidelines. And to make things interesting, some dumb money players have migrated into the smart money crowd, and vice versa, as evidenced by the gains so many Robinhood traders have banked. Market Update Aug 11, 2020

What’s Ahead for the Dow? A Look at Potential Targets

The Dow Jones Industrial Average (DJIA) continues to exhibit impressive strength on the weekly chart, signalling the potential for a 2000-point rally before encountering overbought levels. It’s important to note that markets playing catchup often overshoot their original targets, and the Dow is no exception. Our market indicators suggest a real possibility that the Dow could reach the 29K plus range before experiencing any significant pullback. Traders should closely monitor these indicators to make informed trading decisions.

As the Dow is all but guaranteed to take out 30K, traders willing to take on some risk could deploy extra funds in thirds (one lot at a time) into DIA 300 Jan 2022 calls (one can aim as high as DIA Jan 2022 340 calls) whenever the Dow pulls back strongly. However, if one uses this strategy, then focus on Jan 2022 calls.

This strategy is only for the advanced trader and not for novice traders. If the Dow does not take out its old highs, it means that the Fed is allowing free market forces to rule the markets, and we all know what will happen if free forces are allowed to dominate; in case you are wondering, the markets will tank, so the odds of the Fed’s taking that stance is very low. Right now the odds of Santa Claus flying over your roof are better. Market Update Aug 11, 2020

Market Outlook for 2021

Utilising the right Market sentiment indicators can play a crucial role in the current market scenario, and it is worth considering a contrarian approach in sentiment investing. The Gnosis Panopte Index and the Rage Discontent Index, two market sentiment indicators, show signs of unusual fluctuations, signalling a solid reaction shortly. However, it is essential to approach these indicators with a contrarian mindset. Going against the crowd may seem counterintuitive, but it can often lead to more favourable outcomes.

Going against the crowd can often lead to more favourable outcomes in the long run, as the sentiment may drive prices in the short term, but the fundamentals dictate long-term performance. Hence, taking a step back, analyzing the situation thoroughly, and potentially considering a contrarian approach in sentiment investing can help achieve more favourable results.

The masses are emotional players, and since the inception of time, their only function has been to serve as punching bags and cannon fodder; try hard as you might, but it is impossible to change this equation. Still, it is possible to escape the mass mindset if one chooses to do so. Sol Palha

Why Paying Attention to the Crowd Can Benefit Your Investments

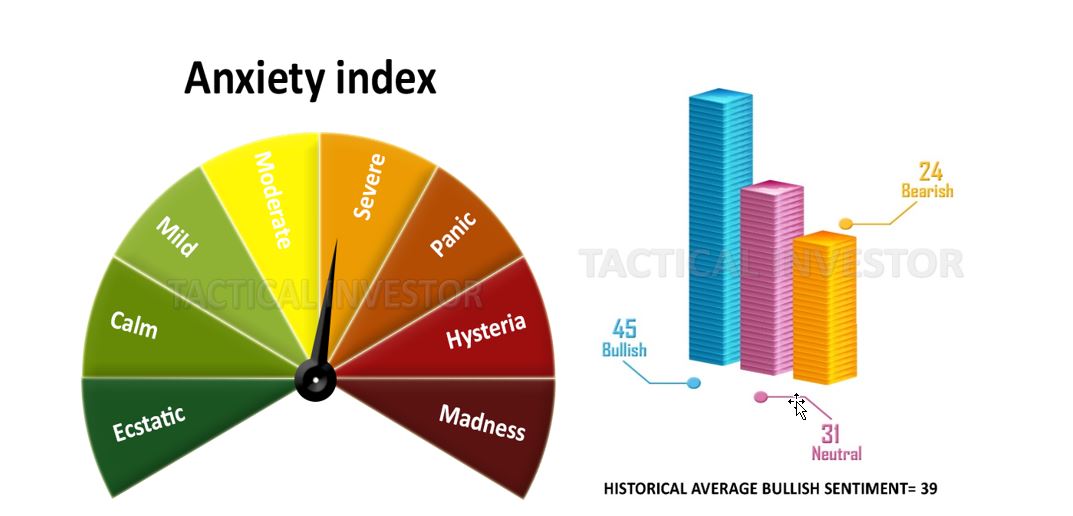

Bullish sentiment is moving up and down but within a narrow range, which suggests that it could experience a blow-off top somewhat similar to market tops, which inadvertently would indicate that a market top is near. As this is an unusual market, we suspect this Yo-Yo action will continue until Bullish sentiment surges past 60. Examined from a different angle, Neutral and bearish players still overwhelm the bulls. Hence, the markets will likely trend upward until the bullish sentiment score exceeds the combined Neutral and Bearish scores. Market Update Dec 21, 2020

It’s essential to remember that market sentiment indicators can be a double-edged sword, and one should not rely solely on these indicators to make investment decisions. While it’s true that the current sentiment readings are showing bullishness, the wise investor must take a step back and analyze the situation from a broader perspective.

Patience is crucial in investing; taking profits along the way is always wise. The recent massive gains in both the options and ETF portfolio, as well as the impressive win ratio in the primary trend portfolio, are a testament to the effectiveness of a patient and steady approach.

On the options front, we closed almost a dozen positions with triple-digit gains, with a win ratio bordering close to 84%. Our entire ETF portfolio is in the black, and we closed several ETF positions with over 60% gains, with the best position yielding over 100%.

While a short-term blow-off top may be in the cards, the severity of the resulting correction is still uncertain. Ultimately, a well-informed and balanced approach that considers both market sentiment and Technical analysis is the key to long-term success in investing.

The Crowd Speaks: Using Sentiment Data to Make Informed Investment Decisions

Remember that market sentiment indicators, such as the trend indicator, are crucial in understanding the current market scenario. A trend indicator is a critical tool that helps investors identify the market’s direction. At the same time, market sentiment indicators provide insights into how the masses feel about the market.

As we move forward, we will closely monitor market sentiment indicators, which provide insights into upcoming trend changes. We remain bullish on the market but will be cautious and ready to adjust our positions to take advantage of buying opportunities.